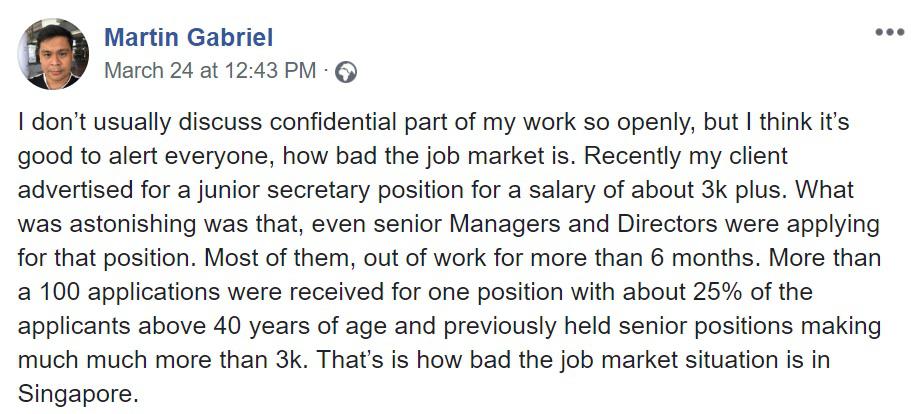

You're happy you applied for a BTO flat. You're even happier you got it. You're on cloud nine when told that your keys are ready, but suddenly you feel like shit after being told that you have to pay $84,000 cash upfront before you can get your house.

Welcome to Singapore, where your dreams can be turned into nightmares in an instant.

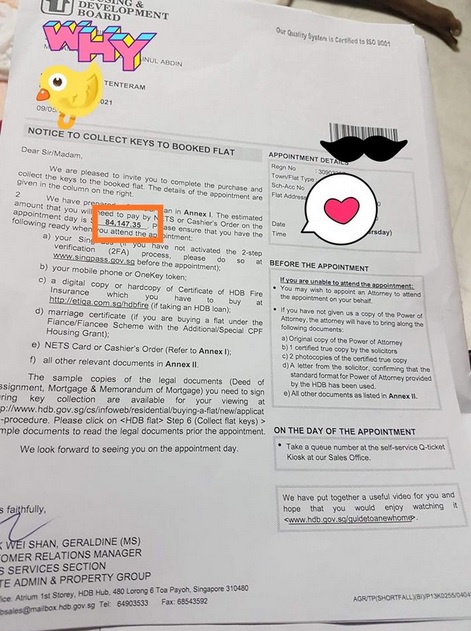

New BTO home owner Liza (pseudoname) was told, without an advance notice, that she had to pay $84,147 in cold hard cash after deducting CPF and loans. She is currently working full-time while her husband is working part-time as a porter, but the both of them cannot cough out such a huge sum of money in a short time.

According to Transitioning.org, "the way HDB mysteriously omit out the loan details for many BTO flat owners have caused heartache for many new flat owners as no one can raise so much cash few days before getting the house keys effectively turning a happy occasion into a nightmarish experience".

Many couples have also ended up going separate ways due to money matters regarding BTO applications.

"As for Liza, she has asked to downgrade her flat to a 3-room one in view of the cash outlay but she has told us that the HDB officer informed her now they will place her flat on hold for a few months until her husband could get a full-time job.

How HDB operates nowadays is a mystery and as more people apply for new BTO flats which can cost up to $200,000 for a 3-room flat in a remote area, one can only hope that the HDB HLE loan department is transparent and upfront on the way it approves housing loan so that new flat owners won’t receive a heart-attack days before their happiness turn into a nightmare".

Credit to Transitioning.org for the story